Powell’s Fed Rate Cues, Reliance AGM To Bolster Indian Stocks

Before the trading day starts we bring you a digest of the key news and events that are likely to move markets. Today we look at:

Article content

(Bloomberg) — Before the trading day starts we bring you a digest of the key news and events that are likely to move markets. Today we look at:

- Reliance AGM nears

- India IPOs outshine US

- Birla’s paints foray

Good morning, this is Chiranjivi Chakraborty, an equities reporter in Mumbai. Indian stocks are set to follow Asian markets higher, as the prospect of Federal Reserve interest-rate cuts boosted sentiment. The upbeat backdrop should keep Indian bulls in high spirits as we kick off the final week of August. It’s going to be an eventful one, with Reliance Industries’ AGM, the June-quarter GDP data, and the monthly derivatives expiry all on the agenda.

Advertisement 2

Article content

All eyes on Reliance AGM; Jio, Retail listing in focus

The week is all about Reliance Industries, as the nation’s most valuable company gears up for its much-anticipated annual shareholder meeting on Thursday. Although the gathering is happening later than usual — blame the lavish wedding in the Ambani family — expectations remain pretty similar to last year. You can see that in Reliance’s share price, which has stayed almost flat over the past month. Sanford C. Bernstein expects the AGM might reveal a potential listing date for Mukesh Ambani’s consumer businesses, Jio and Reliance Retail, along with a timeline for the rollout of the company’s new energy projects.

India’s IPO market returns outshine US, Europe

Returns from IPOs in India are outpacing those in the US, as investors flock to the country’s booming tech startups. This year, 195 companies have gone public, including notable offerings like E-scooter maker Ola Electric, and they’ve delivered an average return of 58%. This gain is far ahead of the 12% mean for US IPOs and 18% for European ones, data compiled by Bloomberg show. At least 20 more companies, including Hyundai Motor’s India unit, are gearing up to tap into the market’s ample liquidity. No wonder the BSE’s index of newly listed firms is up 33% this year, outshining the 14% gain in the main Sensex.

Advertisement 3

Article content

Birla’s paints entry unlikely to disrupt top players

The Birla Group’s bold foray into the paint industry initially put some pressure on existing players, but market watchers are seeing space for new competitors. Nuvama Institutional Equities doesn’t expect Grasim Industries’ entry to disrupt the market, prompting it to take an “anti-consensus” buy stance on the industry’s three main players. With a likely rebound in pricing power and signs of rural demand growth, the sector looks set for a boost. Top player Asian Paints is up 8% this quarter, after slipping 14% in the first half.

Analysts actions:

- Bansal Wire Rated New Buy at Investec; PT 440 rupees

- Devyani Cut to Hold at KR Choksey; PT 185 rupees

- ITC Cut to Accumulate at KR Choksey; PT 545 rupees

- Polycab India Cut to Hold at Systematix Shares & Stocks

Three great reads from Bloomberg today:

- Cheap AI Voice Bots Are Taking Off With Businesses in India

- Powell’s Pivot Leaves Traders Debating Size, Path of Rate Cuts

- Mpox Outbreak: How a Preventable Virus Became a Global Threat

And, finally..

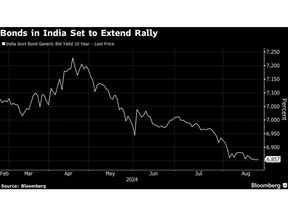

The rally in government bonds looks set to extend as foreigners continue to snap up the notes amid the prospect of interest rate cuts. The yield on benchmark 10-year bond may decline to about 6.50% by March 2025, according to PGIM Mutual Fund, implying a drop of 36 basis points from Friday’s close. The securities, which recently joined a key JPMorgan Chase & Co.’s gauge, are some of the best performing in Asia this year.

—With assistance from Malavika Kaur Makol.

Article content

Source link