LNG Price Slump Speeds Shift Away From Oil for China’s Trucks

A slump in the price of natural gas and the prospect of a glut in the years ahead is spurring sales of trucks and ships powered by the fuel, hastening a long-term shift away from oil in the top importer.

Article content

(Bloomberg) — A slump in the price of natural gas and the prospect of a glut in the years ahead is spurring sales of trucks and ships powered by the fuel, hastening a long-term shift away from oil in the top importer.

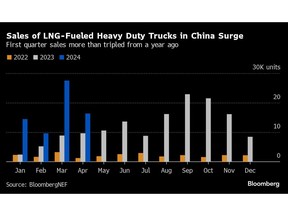

One in three new heavy-duty trucks sold in China in April was powered by the super-chilled fuel that’s more commonly used as a feedstock for electricity generation. That’s up from just one in eight a year earlier.

Advertisement 2

Article content

It’s similar in shipping where liquefied natural gas is one of the main substitutes for dirty fuel oil. Sales of LNG for vessels in the maritime hub of Singapore were 10 times higher in April than a year before.

LNG has been considered an alternative to oil in long-distance transport for some time, but its appeal has been enhanced by a sustained period of low prices following its retreat from a record high in 2022. Expectations prices will stay subdued through this decade thanks to a massive wave of investment in the US, Qatar and elsewhere — is speeding adoption.

While electric vehicles are steadily decarbonizing the light transport fleet, the thinking was that it would take a lot longer for trucking and shipping.

Trucking is a “perfect fit” for LNG to thrive at prices high enough for sellers, said Ira Joseph, a senior research associate at the Center on Global Energy Policy at Columbia University. “It’s a pure substitution play” as it’s competing with more expensive diesel, unlike in the power sector where coal and even renewables are cheaper, he said.

EVs and LNG-powered trucks will replace about 10% to 12% of China’s diesel and gasoline consumption this year, China National Petroleum Corp.’s Economics & Technology Research Institute forecast in March, saying that oil demand there had entered a low-growth phase.

Article content

Advertisement 3

Article content

The Chinese figures on the adoption LNG trucks — from domestic information provider cvworld.com — look like the beginning of a long-term trend. Sales have logged year-on-year increases for every month since the start of 2022, according to BloombergNEF, and the vehicles made up about 7% of China’s heavy duty fleet at the end of last year.

Natural gas is attractive due to “better fuel efficiency, greener emissions, and more policy support in specific provinces in China compared to diesel,” said Shiqing Xia, a consultant at Wood Mackenzie Ltd.

It’s something of a second coming for LNG trucks. Shell Plc and Woodside Petroleum Ltd. made efforts to use the fuel more for transport toward the end of the 2010s.

This time round, LNG looks set to have a more lasting impact on transport, mainly due to it now being cheaper than diesel. There’s also no cartel to prop up gas prices, in contrast to oil where OPEC+ manages supply to buoy the market.

LNG has a “natural arbitrage against other liquid fuels,” which helps to account for the brisk uptake of LNG-fueled vehicles, said Yiyong He, the founder of LNG Easy Pte., a Singapore-based company that supplies the fuel to downstream customers in developing countries.

Advertisement 4

Article content

It’s also becoming more cost-competitive in shipping, where the International Maritime Organization and various governments are pushing for vessel owners to decarbonize.

LNG accounts for around 3% of the global marine fuels market, according to Wood Mackenzie, with the early adopters the gas tankers themselves, followed by container ships. It’s considered one of the most promising alternatives to fuel oil, along with methanol, ammonia and biofuels.

“LNG bunkering has been on an upward trend, and we can expect this momentum to continue,” said Jayendu Krishna, a director at Drewry Maritime Services in Singapore. It’s “likely to remain a dominant alternative fuel,” based on current vessel order books, he said.

While the favorable economics of switching to gas look like they’re here to stay, there’s plenty of factors that could derail the trend, at least temporarily.

There’s a risk that a growing environmental backlash against LNG gathers pace. That’s already happening in the US, where President Joe Biden announced a halt to approving new projects early this year, while Washington looked at the climate impacts.

Advertisement 5

Article content

Gas is cleaner than oil, but it’s still a fossil fuel, making it’s growing preponderance a mixed blessing for efforts to avoid the worst impacts of climate change. Some analysts believe it will slow rather than accelerate the transition to a low-carbon world.

A colder-than-expected winter or supply outages could also cause price spikes for LNG, while, in shipping, some vessel owners may choose to go straight to cleaner alternatives like ammonia when ordering ships, skipping over LNG entirely.

“Given government policies to limit pollution and move freight away from diesel, LNG trucking is likely to remain an important option,” said Michal Meidan, head of China Energy Programme at the Oxford Institute for Energy Studies. “But it will ebb and flow based on prices.”

—With assistance from Stephen Stapczynski.

Article content

Source link