Maximizing Market Volatility – Modest Money

Looking for a trading strategy that thrives on market volatility? The Reverse Iron Condor strategy might just be the high-octane approach you’re searching for. Tailored for environments where significant price swings are expected, this strategy is designed to capitalize on large movements, regardless of the direction.

As I dive deeper into the mechanics of the Reverse Iron Condor, you’ll discover how this strategy sets itself apart by not just managing risks associated with volatile markets, but by actively seeking to profit from them.

Whether you’re a seasoned trader or someone looking to expand their trading playbook, understanding the Reverse Iron Condor could unlock new potential in your investment strategies.

Stay tuned to explore how to harness the power of volatility for substantial gains. If you like to learn through videos, here is one to consider:

Key Takeaways

- The Reverse Iron Condor strategy utilizes both bear put and bull call debit spreads, capturing movements in either direction of the market.

- This approach is well-suited for markets expected to experience significant price swings, regardless of the direction.

- Initial setup costs define both the maximum risk and cap on potential profits, making budgeting straightforward.

- Traders must be experienced and capable of managing complex positions to effectively use the Reverse Iron Condor strategy.

What is The Reverse Iron Condor Strategy?

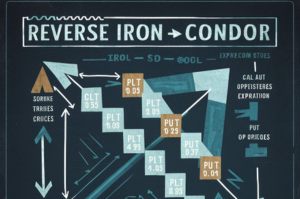

The Reverse Iron Condor strategy is a sophisticated options trading approach that cleverly combines both bear put and bull call debit spreads on the same underlying security, all sharing the same expiration date. This forms what is visually represented as a condor on profit and loss diagrams, earning the strategy its name.

To construct this setup, you would initiate by purchasing a bull call debit spread positioned above the current stock price, along with a bear put debit spread set below the stock price. This configuration effectively captures movements in both directions, upwards with the bull call spread and downwards with the bear put spread.

The unique structure of this strategy also offers a clear definition of both potential profits and maximum risk right from the onset. The combination of spreads ensures that while the initial debit paid establishes the maximum loss, the strategy also caps the maximum profit potential due to the outer strikes of the sold options in both spreads.

Thus, while you gain the advantage of a reduced cost basis thanks to the collected premiums on the outer options, you must also accept that these same premiums limit your maximum profit potential.

When You Should Use The Reverse Iron Condor Strategy

The Reverse Iron Condor strategy is particularly effective when one anticipates significant movements in a security’s price, but are unsure of the direction. This options strategy is structured to capitalize on significant shifts in the underlying asset’s price, regardless of whether these movements are upward or downward.

It’s a refined tool in an options trader’s arsenal, especially suited for highly volatile environments where large price swings are expected. I find that the Reverse Iron Condor strategy shines in conditions where the market is restless, and the stock is likely to move sharply from its current position.

The success of this strategy hinges not on the direction of the stock moves but on the magnitude of these movements. Ideally, the price should deviate substantially from the strike price at the center of the condor setup to turn a profit.

This approach involves opening positions that cover both potential upward and downward movements, making it a market-neutral strategy. This complex strategy offers a balanced approach between managing upfront costs and maximizing the potential for profit through well-timed entries in a volatile options trading environment.

What Type of Trader Should Use The Reverse Iron Condor Strategy?

The Reverse Iron Condor strategy is ideal for options traders who possess a high risk tolerance and significant experience in navigating the complexities of the options market. Given the nature of the Reverse Iron Condor, it is a volatile strategy that thrives in environments of heightened market volatility, where the potential for large price movements increases.

Traders must be proficient at predicting these movements to position their options trades advantageously before the current price of the underlying security breaks out beyond the upper breakeven price or falls below the lower breakeven point.

This strategy is marked by its limited profit potential, which is balanced by similarly limited risk, making it attractive to traders who are prepared to manage multiple complex positions simultaneously. Traders need to be aware of the time before expiration, as the Reverse Iron Condor’s effectiveness can be influenced by time decay, affecting both max gain and unrealized profit scenarios.

Experienced traders who understand how to leverage this strategy can effectively use it as a neutral options trading strategy, particularly in high-volatility markets where the precise direction of the underlying asset’s price movement remains uncertain.

As such, it serves as a strategic component of a well-rounded trading approach, particularly for those who specialize as volatility traders. If you don’t seem to fit this bill, check out my option hedging strategies or low risk option strategies articles for alternatives ways to thrive in the options market.

How To Execute a Reverse Iron Condor Strategy: A Step-By-Step Guide

Executing a Reverse Iron Condor strategy involves several precise steps that can capitalize on expected volatility without taking a definitive position on the direction of the market movement. Here’s a step-by-step guide to setting up this strategy:

Step 1: Identify the Underlying Security

Choose an underlying security that you expect will experience significant price movement within a short period. This could be due to an upcoming earnings report, a major announcement, or other market-moving events. To help you find the ideal stock for the reverse iron condor strategy, I suggest using a service like Simply Wall St. Check out my Simply Wall St review to see how they can assist in this process.

Step 2: Select Appropriate Strike Prices

- Buy a Bull Call Spread: Purchase a call option at a lower strike price and sell a call option at a higher strike price. Both options should have the same expiration date and be out-of-the-money.

- Buy a Bear Put Spread: Simultaneously, purchase a put option at a higher strike price and sell a put option at a lower strike price, also with the same expiration date and out-of-the-money.

Step 3: Assess Premiums and Costs

Evaluate the premiums for the options to determine the initial debit, which is the net cost of entering the trade. This cost is your maximum potential loss and should align with your risk tolerance.

Step 4: Monitor the Market

Once your position is established, closely monitor the underlying security’s price movements. The goal is for the price to move sharply enough to surpass either the upper breakeven point of the bull call spread or the lower breakeven point of the bear put spread.

Step 5: Execute the Exit Strategy

Decide in advance under what conditions you will exit the trade. You may choose to close the position if:

- The stock price moves beyond one of your breakeven points, potentially allowing you to realize gains.

- The stock price stays within the strike prices, approaching expiration, which might necessitate closing the position to avoid total loss on the premiums paid.

Step 6: Manage and Adjust

Be prepared to adjust your spreads if the market does not react as expected. This might involve rolling the spreads to different strike prices or expiration dates to better align with new market conditions or outlooks.

Step 7: Review the Trade

After closing the position, review the outcome against your expectations. Analyze the effectiveness of your strike price selection, timing, and response to market movements. Use these insights to refine your strategy for future trades. A solid trading journal like TraderSync can streamline this process.

This strategy requires a solid understanding of options trading, specifically the nuances of strike selection and timing in relation to market events. Traders must be vigilant and proactive in managing their positions, especially in volatile market conditions where the Reverse Iron Condor can either thrive or falter.

Calculating The Break Even Point For The Reverse Iron Condor Strategy

Upper Break Even Point = Long Call Strike + Total Cost

Lower Break Even = Long Put Strike – Total Cost

The Reverse Iron Condor Strategy: My Final Thoughts

The Reverse Iron Condor strategy is an exceptional tool for traders looking to harness the potential of volatile markets. By strategically buying and selling bull call and bear put spreads, traders can position themselves to benefit from significant price movements.

I must note that this strategy demands a deep understanding of options mechanics, precise timing, and proactive trade management. For those who master it, the Reverse Iron Condor provides a powerful addition to their trading arsenal, especially in uncertain market conditions where traditional strategies might fall short.

Source link