Marc Andreessen, Sequoia again back Kearny Jackson, this time in $65M Fund III

After securing $14 million for its second fund in 2023, early-stage VC firm Kearny Jackson is back with a third fund, this time bringing in $65 million in capital commitments, including from a number of first-time institutional funds.

The bi-coastal Kearny Jackson invests in B2B SaaS and infrastructure as well as fintech infrastructure, often leading or co-leading rounds.

“One of the things that we emphasize with founders that launch with us is time to value,” co-founding general partner Sriram Krishnan told TechCrunch. “We are pretty fortunate to have the LP mix that we do have, because at the end of the day, we want to build a preceding seed-stage platform that has a phenomenal brand, but also that is able to work as quickly as the founders.”

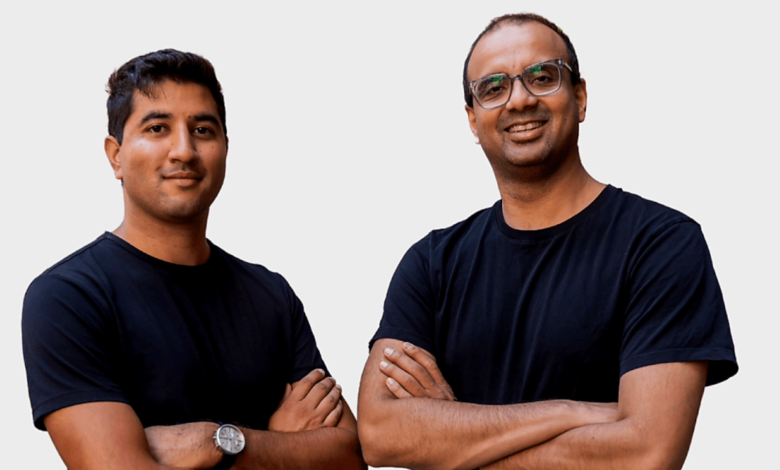

Krishnan, who did product management stints at Tinder and Spotify, and his co-founding general partner, Sunil Chhaya, who was previously with Menlo Ventures and Tenaya Capital, say they have no problem investing in a team that is both pre-revenue and pre-product.

Thanks to Chhaya’s background as a venture capitalist and Krishnan’s as a founder/operator, they drew interest from limited partners like Sequoia and Marc Andreessen.

“Sunil and I have known each other for a long time,” Krishnan said. “He comes from a dog-eat-dog world of Series A and Series B investing. We have a blend of background to write bigger checks, but also the experience to help these founders.”

The pair declined to disclose the names of all the limited partner investors in the new fund, however, they did say they included more than three endowments, as well as pension funds, including Stepstone, and funds of funds. Sequoia, which invested in Kearny Jackson’s second fund, is back with a 5x commitment, they said.

Other LPs include Bain Capital Ventures and Menlo Ventures, along with a number of individual investors, including Andreessen (personally, not through Andreessen Horowitz), who also invested in Fund II, plus former GitLab CTO Eric Johnson, former Spotify CTO Andreas Ehn, Unit co-founder Itai Damti and Insight founder Jeff Horing.

The significantly larger size of their third fund gives the duo more leverage, but they’re glad they started small.

Now having a bigger fund size, the pair can execute on their strategy of gaining more ownership into their portfolio companies. Kearny Jackson targets 6% to 10% ownership stake in companies, investing around $1.5 million in pre-seed and seed-stage startups. That’s smaller than the typical 15% to 20% stake most early-stage firms aim for, says Chhaya, which could help them compete for deals.

Krishnan and Chhaya expect to invest in between 30 and 35 companies over the next three and a half years. They have already made one stealth investment in a startup led by an ex-Snowflake team.

“Before, we were introducing our founders to lead VCs, and we’re now in the position to be that ourselves,” Krishnan said. “Had we gone with a bigger fund, I don’t think our strategy would have resonated as much. Here, we can get the ownership we want and can also work with big VCs or smaller VCs.”

Chhaya added that they are “well-suited to support these founders at the early stages.” As a result, founders often joke that they get “two for the price of one,” he said.

Notable investments from its first two funds include database company MotherDuck, engineering software company Cortex, insurance brokerage Comulate, Ethereum protocol EigenLayer, developer tools company Sprig and workplace productivity company Rhythms.

Source link