Asian Shares Eye Declines Ahead of Rate Decisions: Markets Wrap

Asian stocks are poised for a weak open as traders await major central bank decisions, key economic data and earnings from four US megacaps worth nearly $10 trillion.

Article content

(Bloomberg) — Asian stocks are poised for a weak open as traders await major central bank decisions, key economic data and earnings from four US megacaps worth nearly $10 trillion.

Futures show equity benchmarks in Tokyo, Hong Kong and Sydney will fall in early trading Tuesday, following a rotation in the US that drove the Nasdaq 100 to the brink of a correction. The S&P 500 closed little changed and small caps slipped. US stock futures were steady in early Asia hours.

Advertisement 2

Article content

Results from Microsoft Corp., Meta Platforms Inc., Apple Inc. and Amazon.com Inc. will be crucial after an underwhelming start to the megacap reporting season. Federal Reserve officials are on the verge of lowering rates within months, a move Jerome Powell may signal Wednesday. Major central banks are also set to meet in Tokyo and London, with traders closely watching the Bank of Japan for signs of a hike and the Bank of England for a potential cut.

“The Fed and tech earnings will have the spotlight for the week,” said Paul Nolte at Murphy & Sylvest Wealth Management. “The future direction of interest rates should be clearer after the press conference. Big tech can answer whether investors’ expectations for still high growth rates is warranted.”

The S&P 500 hovered near 5,465 on Monday. A gauge of the “Magnificent Seven” megacaps gained 1%. The Russell 2000 of smaller firms fell 1.1%. Tesla Inc. jumped on a bullish Morgan Stanley call. McDonald’s Corp. investors shrugged off a sales drop as executives pledged to launch new promotions. Energy producers joined a slide in oil.

Article content

Advertisement 3

Article content

Treasuries barely budged, but headed toward a third straight month of gains — the longest run since 2021. The US cut its estimate for federal borrowing for the quarter and projected its cash buffer to fall toward year-end. And companies are rushing to debt markets to raise cash before the Fed decision.

US policymakers, who’ve kept rates at a more than two-decade high for a full year, are widely expected to leave them there again on Wednesday. But investors see officials signaling a move in September as risks grow of imperiling a solid, but moderating job market.

Investors have begun the week desperate for answers to questions about the near-term path of global monetary policy after conflicting signals from key economies upended markets. At stake are recent surges in the yen and pound, as well as the decline of short-term US Treasury yields. Multiple markets ended last week looking jittery due to the uncertain outlooks for policy and economic growth.

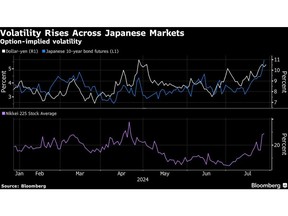

Bank of Japan Governor Kazuo Ueda will have investors on high alert Wednesday when he lays out a detailed plan for quantitative tightening after years of massive easing. He may also double down by adding an interest rate hike to boot.

Advertisement 4

Article content

July’s wild ride in stocks has underscored how betting on seven large tech companies is no longer a simple, slam-dunk trade. During most of the month, investors jumped into other corners of the market on speculation Fed cuts will further boost Corporate America. Still, the S&P 500 ended up suffering two straight weeks of losses, dragged down by its most-influential group – technology.

“It’s almost impossible to know if the worst of the recent market pullback is over, but we continue to believe the equity market backdrop is favorable due to resilient growth, falling inflation, likely Fed rate cuts, and AI spending,” said David Lefkowitz at UBS Global Wealth Management.

To Morgan Stanley’s Michael Wilson, a dimmer outlook for US corporate earnings is likely to hurt stocks that are tied to the economy, as investors worry about the impact of falling inflation on pricing power.

The strategist — who was among the biggest bearish voices on US stocks last year — said that a gauge that measures profit upgrades versus downgrades has turned weaker, as is typical for this time of the year. That’s being driven primarily by so-called cyclical sectors.

Advertisement 5

Article content

RBC Capital Markets strategist Lori Calvasina also said trends in earnings revisions don’t yet support a further rotation in market leadership.

Key events this week:

- Eurozone economic confidence, GDP, consumer confidence, Tuesday

- US JOLTS job openings, consumer confidence, Tuesday

- Microsoft earnings, Tuesday

- Eurozone CPI, Wednesday

- Bank of Japan policy decision, Wednesday

- US ADP employment change, Wednesday

- Fed rate decision, Wednesday

- Meta Platforms earnings, Wednesday

- Eurozone S&P Global Eurozone Manufacturing PMI, unemployment, Thursday

- US initial jobless claims, ISM Manufacturing, Thursday

- Amazon, Apple earnings, Thursday

- Bank of England rate decision, Thursday

- US employment, factory orders, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 closed little changed; futures were steady as of 7:37 a.m. Tokyo time

- Hang Seng futures fell 0.2%

- S&P/ASX 200 futures gell 0.7%

- Nikkei 225 futures fell 0.4%

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro was little changed at $1.0822

- The Japanese yen was little changed at 154.06 per dollar

- The offshore yuan was little changed at 7.2717 per dollar

- The British pound was little changed at $1.2865

- The Japanese yen fell 0.1% to 153.99 per dollar

Cryptocurrencies

- Bitcoin fell 0.2% to $67,252.59

- Ether was little changed at $3,322.69

Bonds

- The yield on 10-year Treasuries declined two basis points to 4.17%

Commodities

- West Texas Intermediate crude was little changed

- Spot gold was litte changed

This story was produced with the assistance of Bloomberg Automation.

Article content

Source link