RBA Set for Hawkish Hold, Trailing Global Peers in Easing Cycle

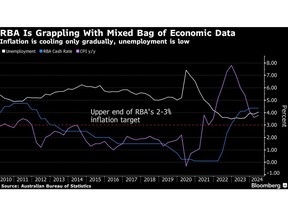

Australia is poised to stay near the back of the global easing cycle as local inflation — while cooling — remains elevated requiring the Reserve Bank to keep its key interest rate at a 12-year high.

Article content

(Bloomberg) — Australia is poised to stay near the back of the global easing cycle as local inflation — while cooling — remains elevated requiring the Reserve Bank to keep its key interest rate at a 12-year high.

The RBA will hold its cash rate at 4.35% for a sixth straight meeting on Tuesday, economists predict. The board’s decision will be released at 2:30 p.m. in Sydney together with the bank’s quarterly update of economic forecasts, followed an hour later by Governor Michele Bullock’s press conference.

Advertisement 2

Article content

Australia’s policy decision follows a highly-anticipated meeting by the Federal Reserve last week, when Chair Jerome Powell signaled the US is on course to begin easing in September. The Bank of England also last week cut rates for the first time since early 2020 and signaled further reductions ahead.

Bullock is unlikely to draw from that playbook, however, with economists expecting the RBA will again debate hiking rates, before agreeing to stand pat.

“The RBA can’t afford to jettison the hawkish bias,” said Josh Williamson, economist at Citigroup Inc. “The RBA needs to deliver a hawkish on-hold message, stating that while further progress on inflation has been made, it is too early to consider unwinding tight policy.”

Bullock has retained maximum policy optionality this year, saying she needs to be confident that price growth is moving sustainably back to the central bank’s 2%-3% target and as a result the board isn’t ruling anything in or out.

Data last week showed Australia’s core inflation unexpectedly decelerated in the quarter-ended June, prompting money markets to swing to pricing an 88% chance of a rate cut in December, according to meeting-dated OIS contracts, and fully price one for February.

Article content

Advertisement 3

Article content

The yield on Australia’s policy-sensitive three-year bond hit the lowest level since April on Friday, in response to the CPI and dovish shift at global central banks. The Australian dollar also slid against the greenback.

Still, at 3.9% core inflation remains well above the RBA’s target and economists don’t expect the bank’s latest forecasts to deviate significantly — outside lower headline prices to reflect government energy subsidies — from its current track of bringing CPI back to the band in late-2025.

The slowdown in price pressures has bolstered confidence among economists, including former RBA Assistant Governor Luci Ellis, that rate cuts could start earlier. But they reckon the bank will continue to talk tough in the near-term until it’s confident in the trajectory of prices.

“The board is not in a hurry to cut given lingering inflation risks,” said Ellis, who is now Westpac Banking Corp.’s chief economist. “It is plausible that the board will retain the ‘not ruling anything in or out’ language in its post-meeting communication. We also anticipate that rates will decline only gradually.”

Advertisement 4

Article content

The RBA has taken an unorthodox approach this cycle by hiking less than global counterparts — its key rate is 1 percentage point below that of the US — as it tries to hold onto post-Covid job gains. Unemployment has remained surprisingly low — at 4.1% — though that has been aided by strong government hiring at the state and national levels.

The RBA’s lower cash rate may explain why inflation has proved sticky, and it’s probably premature to say price pressures have been defeated Down Under. Core CPI at 3.9% is still well short of the bank’s 2-3% target, which the RBA only expects to reach late next year. A failure to meet that forecast would damage its inflation-fighting credentials.

What Bloomberg Economics Says…

“While we think a rate hike will be on the table at the August board meeting, our bet is that the RBA will opt to remain in a high-for-longer holding pattern for now.”

—James McIntyre, economist

A key uncertainty, economists say, is how households respond to income tax cuts and energy rebates that kicked in last month. Indeed, with government spending set to strengthen ahead of a likely 2025 election, the RBA will be reluctant to signal too early that the next move is down.

Advertisement 5

Article content

Policymakers will also keep a close eye on immigration, which has been a key support to the economy and partly to blame for some of the inflation pressures.

Latest data showed annual net migration still held near its record pace at 547,000 people in the final quarter of 2023, though the trend appears to be slowing with a drop in temporary and student visas.

“UBS have long expected strong migration led population growth, in addition to fiscal spending, to lift consumer demand, asset prices and inflation,” said Nicolas Guesnon, economist at UBS AG. “However, if fiscal policy is tighter than expected, or population growth slows below the government projects, then the RBA would have scope to ease earlier.”

—With assistance from Shinjini Datta and Matthew Burgess.

Article content

Source link