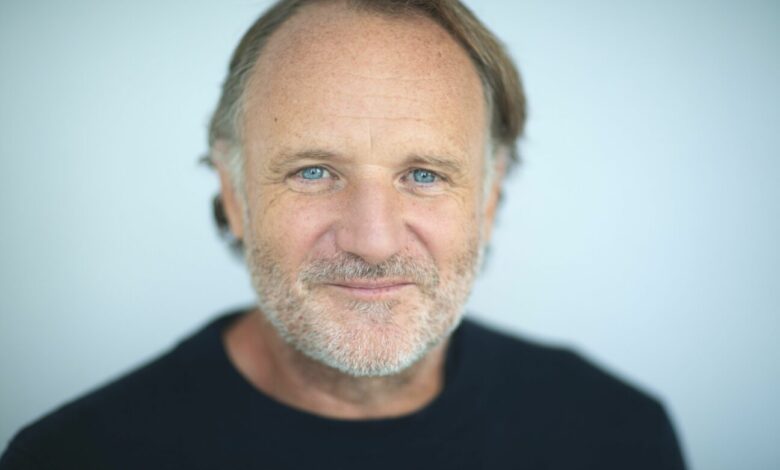

Denis Ladegaillerie has Believe back in his arms – and he’s eyeing a huge acquisition

Prediction: the recorded music industry is likely to see at least one $1 billion-plus acquisition of a distribution and services player over the next 12-24 months.

Surprise: the company behind said acquisition could well be Believe.

That’s according to Believe founder and CEO, Denis Ladegaillerie, speaking exclusively to Music Business Worldwide.

Ladegaillerie picked up the phone to MBW earlier today following the news that his consortium – which Ladegaillerie jointly owns with EQT and TCV – now owns 95% of Believe via a recent share tender process

Ladegaillerie made clear that, under the ownership of the new consortium, Believe is planning to spend EUR €200 to €300 million per year on acquisitions to grow its global business.

That’s two to three times bigger than the firm’s yearly acquisition budget following its IPO, he said. (Believe has in the past acquired companies like TuneCore in the US, Sentric Music in the UK, Venus Music in India, Nuclear Blast in Germany, and more.)

“We will consider a transformative [acquisition] target in the next 24 months,” said Ladegaillerie, confirming that such a deal would require additional capital to that currently in Believe’s M&A budget.

“You have a lot of mid-level businesses in the market, perhaps more on the publishing side than the recorded music side.”

Noting that Believe was seeking to find the “right strategic fit”, Ladegaillerie praised several recorded music businesses, including artist services companies and mid-size indies.

He also noted that larger companies with strong music publishing catalogs, including Kobalt and BMG, may be open to transformative partnerships in the months and years ahead.

(Amongst relevant companies recently in the news: US-based Create Music Group just achieved a $1 billion valuation, while SoundCloud , at a similar valuation, is seeking a financial event that may result in new investors or a sale.)

“Any company may not necessarily be for sale at any point in time, so you have to be pragmatic about these things,” said Ladegaillerie when discussing Believe’s potential “transformative target”.

He added: We would need to feel strongly that any [acquisition] target could bring us growth acceleration and improved positioning in the market.”

Believe is particularly interested in accelerating its business in the US and the UK, said Ladegaillerie.

“The No.1 driver of our acquisition strategy is the world’s Top 10 markets,” he said. “We’re already in the top three players in four of those markets – France, Germany, Japan, and India. But we haven’t achieved that in the US and the UK [predominantly due] to us not previously investing at the level required to do so.”

Ironically enough, Ladegaillerie and co. may face competition to pull off a “transformative” acquisition of an artist services company in the States from Warner Music Group, whose CEO, Robert Kyncl, has indicated that he’s keen to swiftly grow WMG’s presence in the so-called “middle class” artist market.

Kyncl and Warner, of course, came close to tabling a $1.8 billion takeover bid for Believe (rivaling Ladegaillerie’s own consortium-based acquisition plan for the company), but WMG ultimately didn’t form an offer and pulled out of negotiations.

In a wide-ranging discussion abridged into the following Q&A, MBW asked Ladegaillerie about his personal experience of that Warner process.

We also discovered why he thinks an extraordinary amount of growth is coming to large-scale companies that service indie artists, and how Believe – under new ownership – plans to make the most of that opportunity…

Your consortium with TCV and EQT now owns 95% of Believe (technically 94.99%!). What happens now? Will you buy the additional 5% at some point?

We are pretty much where we wanted to be. Our objective was to have a new set of shareholders who could grow the business at an accelerated rate. We have started engaging in deeper discussions with larger [acquisition] targets, which we were not in a position to do previously.

Tomorrow, if we need to raise [additional] capital, we are in a position with our base of shareholders to do that in a way that’s easy and efficient.

To answer your second question, the goal in the grand scheme of things is to take the company fully private. We will have dialogue with the market authorities about the best way, and when, to take that step but there is no hurry.

“We have started engaging in deeper discussions with larger [acquisition] targets, which we were not in a position to do previously.”

You’re talking about raising funds. That suggests EQT and TCV are strategically aligned with you on heavily investing in tomorrow’s music business.

Absolutely. Our thesis and the main reason we sought new shareholders is that there’s an opportunity to accelerate our profitable growth story through acquisitions in a number of markets.

I’m talking about larger acquisitions than we’ve done recently. We’ve been doing EUR €100 million of bolt-on acquisitions per year. Our target now is to do about two to three times that amount.

What characterizes your acquisition targets right now?

We are aligned with EQT and TCV to supercharge our existing organic growth. We will continue to invest in our organic growth strategy and make acquisitions to grow market share.

The No.1 element of our acquisition strategy today is in the Top 10 markets. We want to become a No.1 player in those markets. We are already the largest player in France; the third largest player in Germany; the largest player in India; the third largest player in Japan. We want to do more. The US, UK, and Japan are all key priorities for us.

At the same time, we will continue making very qualitative, targeted acquisitions across [smaller] markets as you’ve seen recently in Turkey, the Philippines, and elsewhere.

Why is the US of such interest when you’ve traditionally not over-invested there? And what’s your game plan? it’s not easy making a splash in the world’s biggest market!

We believe the US market is starting to transform towards independent [services companies].

We are considering a transformative [acquisition] target in the next 24 months. There are a lot of mid-level businesses in the market, perhaps more on the publishing side than the recorded music side.

“We are considering a transformative [acquisition] target in the next 24 months.”

Any company may not necessarily be for sale at any point in time, so you have to be pragmatic about these things.

We would need to feel strongly that any [acquisition] target could bring us growth acceleration and improved positioning in the market.

That’s big news – and speaks to your ambition. Surely you’re going to need more than €300 million per year to fulfill such a goal?

During the Warner [discussions] someone actually asked me: ‘Hey Denis, rather than Warner buying Believe, do you actually want to buy Warner?!’ [laughs]. That gives you a sense of how big we’re thinking.

The €300 million a year figure is for ‘business as usual’ acquisitions. What we’re discussing here is separate. We are not preventing ourselves from looking at any company.

“What you see right now is a very dynamic market with a number of mid-level companies in the USD $1 billion to $2 billion range considering their strategic options.”

What you see right now is a very dynamic market with a number of mid-level companies in the USD $1 billion to $2 billion range considering their strategic options.

I think the probability of something transformational, very significant, at scale happening in the next 12-24 months is extremely high.

We want to operate as a credible, better alternative to major labels in the world’s biggest markets.

Believe and BMG’s annual revenues are at similar levels. Did it twig your attention that, just as all of the Believe/Warner/takeover noise was happening, Thomas Rabe, CEO of BMG parent Bertelsmann, SUGGESTED THAT BMG MIGHT CONSIDER A MERGER with a rival music company?

[Laughs] Yes, of course! As I said, we’re looking for businesses where there is an ability to [combine] and actually accelerate the business.We have some synergies with BMG but we’re very different in terms of geographical positioning etc. However, it’s one of the interesting discussions that we should have in the market!

Now the dust has settled, what’s your take on what happened with Warner? At one point, their hostile takeover attempt looked like it might snatch Believe from you – then it was all over.

Several positives resulted from that process.

It was a very strong validation of our model and our status as a modern, innovative, well-structured, technologically strong music company.

“watching the Warner [negotiations] made me appreciate that Believe has a really smart team who are also very experienced in music.”

I like Robert; I like the Warner team. They’re very smart people and we had good discussions. I personally opposed the hostile [takeover] because I think the opportunity ahead of us is very significant. I didn’t want to get dragged into an integration over the next two years where there’s such a big opportunity ahead of us [as an independent company].

My last takeaway: watching the Warner [negotiations] made me appreciate that Believe has a really smart team who are also very experienced in music.

Believe IPO’d in SUMMER 2021, and it was an exciting time. Now that you’re seemingly on the way to re-privatization, what are your feelings on the experience of going public? What have you learned from it?

It has been generally costly – getting listed means paying a lot of lawyers and bankers! – but it’s also been very positive in terms of elevating the level of requirements by which we operate as a business.

It’s also helped us understand how investors view the music market. Even as a [potentially] private company in the future, we will hold ourselves to the same standards that we have abided by as a public company.

A couple of quick questions on recent industry themes/headlines: What do you make of the major music companies suing Suno and Udio over alleged mass copyright infringement?

Technology companies are using copyrighted music as raw materials for machine learning to then create products that have value. If you’re doing that, you must get consent [from the copyright owners] and remunerate them. Defending that is part of our duty towards artists.

“these [lawsuits] are the logical outcome.”

Other companies like Google, Meta, etc., are acknowledging that if they use music [for gen AI], they need to compensate artists and collaborate with the industry. For companies that do not have that dialogue and who are stealing content to build their model, these [lawsuits] are the logical outcome.

Going after these companies that are not behaving right, while having constructive dialogue with those taking a reasonable approach; that is the right way to go.

Sony boss Rob Stringer RECENTLY SUGGESTED that in some mature markets – particularly the US – it’s time for Spotify to charge a fee for its free tier, effectively bringing the end to ‘free’ interactive audio streaming. What do you think about that?

I think Rob is asking the right question: When is it time to make that balance between free and paid? It’s an ongoing dialogue with Spotify.

In India, for example, we have spoken to Spotify about the fact that locally you still have a few players with a very generous free tier which is probably preventing the [adoption] of subscriptions in that market.

“Rob is asking the right question.”

My take on this has always been the same: Whether it’s Sony or Believe, we are aligned with Spotify in the sense that we all benefit from maximizing the value of people listening to music.

If [changing] the free tier would generate more revenues by encouraging [currently free] users to subscribe, then Spotify, like us, has a vested interest in doing it.Music Business Worldwide

Source link